For example, we don’t count the house you own if you live in it, and we usually don’t count your vehicle. We don’t count everything you own when we decide if you can get SSI. A couple may be able to get SSI if they have resources worth $3,000 or less.

You may be able to get SSI if your resources (the things you own) are worth $2,000 or less.

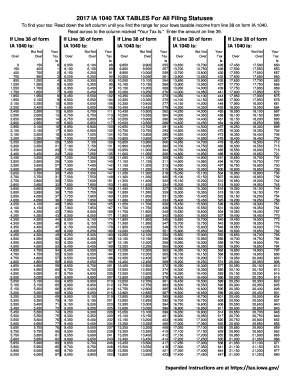

#Iowa income tax tables 2020 free

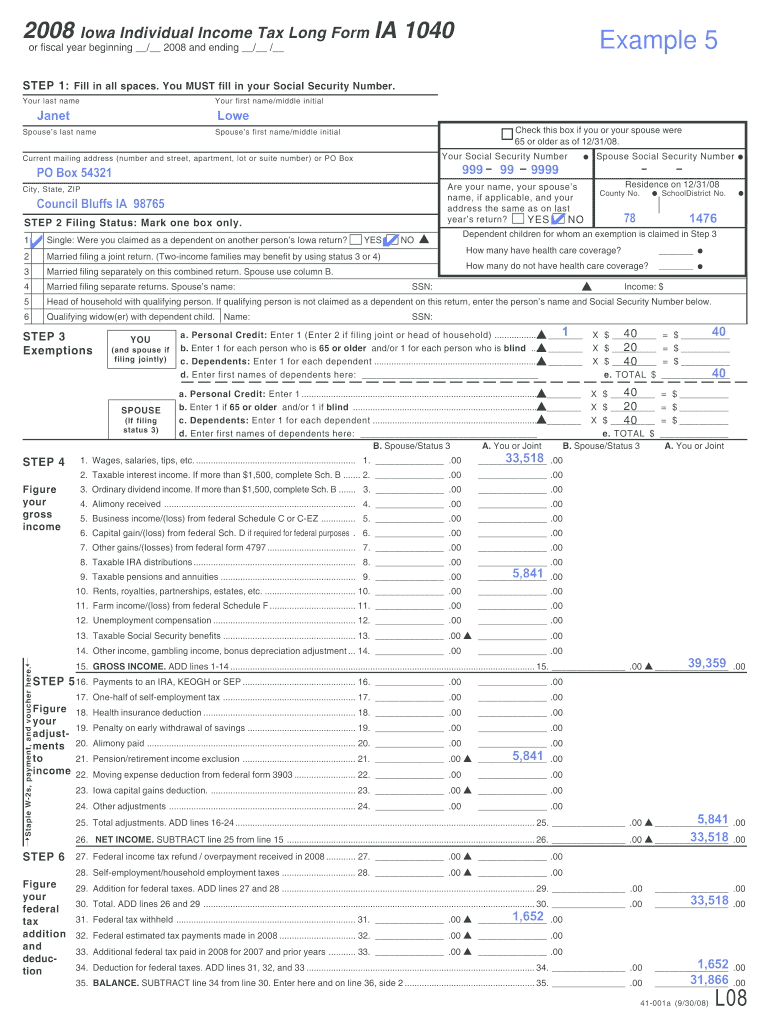

Income also includes such things as food and shelter you get free or for less than its fair market value. Income is money you receive such as wages, Social Security benefits, pensions, workers compensation, unemployment benefits, and money from friends or relatives. Whether you can get SSI depends on your income and resources (the things you own). A person whose sight isn’t poor enough to be “blind” may still be considered to have a qualifying disability. Also, under both programs, we consider a person “blind” if they have vision no better than 20/200 or a limited visual field of 20 degrees or less in the better eye with the use of eyeglasses. To get disability payments, you must have a medical condition that is expected to last at least one year or result in death. However, the medical requirements are the same for both programs. Tax year 2022 income tax brackets are as follows: 0.33 for taxable income between 0 and 1,743. SSI is different from our Social Security Disability Insurance (SSDI) program. You may be eligible even if you think you have resources over these limits. Note: We automatically exclude some things like ABLE accounts, some trusts, and some burial funds. Note: If you have a disability and have other expenses related to work you may still be eligible for SSI. Less than $3,000 total if you are a couple. Less than $1,391 per month if you are a couple. Less than $2,827 per month in wages (before taxes and other deductions) or self-employment (after deduction of allowable business expenses) if you are a couple. Less than $934 per month if you are an individual. Less than $1,913 per month in wages (before taxes and other deductions) or self-employment (after deduction of allowable business expenses) if you are an individual.

2023 SSI Income and Resource Eligibility Table Gross wages or net self-employment income Note: Exclusions may apply to the income and resource limits in each of the columns below. 67.25 for the 2020 Assessment 63.75 for the 2021 Assessment equal to the residential rollback for the 2022 Assessment. The table below shows the maximum income and resources you can have to qualify for SSI. To get SSI you must have limited income and resources.

0 kommentar(er)

0 kommentar(er)